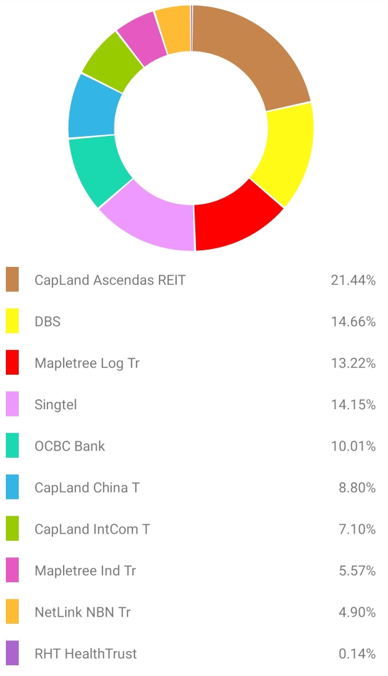

Have been adding Mapletree Industrial Trust @ 2.23 & 2.30, CapitaLand China Trust @ 0.90 and Mapletree Logistics Trust @ 1.47 in September and October.

These are incremental purchases added to existing positions. Nothing has changed among my top four positions.

Have

been planning to add Ascendas Reit too but price has ran up abit today

so will hold on first. However any price below 2.70 remains attractive

for this counter.

Reason for adding the above is simple. I have confidence in the business of MIT and MLT in a timeline that is aligned with my portfolio.

For CLCT, it is mainly to lower my cost. For this counter, one parameter I will follow closely on would be its gearing which is getting uncomfortable for me. It is for this reason that I have reservation on bigger purchase.

Also, more than half of the business park assets lease would be due for renewal in the coming two years. It would be interesting to see how the management handle this and at the same time improve on the occupancy at the Singapore-Hangzhou Science Technology Park asset.

The macro environment including China's projected economy and weakening of Yuan against SGD is important monitoring factor for this counter as well.

At point of writing, my local SGD portfolio is down 6.16%.

Will continue to make use of the market volatility to add in batches. As usual, time in the market for me, not timing the market.

No comments:

Post a Comment