Been couple of months since my last post. Was busy with work, side line, school and life in general though have to say it's pretty fulfilling.

Work:

Secured some projects which I am working on concurrently.

Also recently completed a mid sized project in a cyclical industry which is currently on the downtrend in terms of outlook.

Side line:

Have been spending some hours on weekday mornings doing this.

I just looked at my records. Apparently I netted an average of $750 per month from this side line which I started around August last year.

I'm still learning and trying to improve as I do it. Hopefully the earnings will increase along with the mastery.

School:

One of the main things that kept me busy. Readers might recall I am taking my Masters now on a part time basis at NUS.

Just received the results for this semester. Got a B, B+ and A+ for the three modules taken.

Must admit I was a little disappointed but that's life. Good thing is that my CAP of 4.4 is still a safe distance away from the minimum CAP of 3.0.

Up until the last week before the exams, my classmates and I were still engaged in projects. Such rigor though that makes the course a fun challenge.

On top of that I am also busy with my dissertation which is due on January next year. The aim is to complete as much as I can during these two months before semester starts again.

So far I am enjoying the learning process. Maybe it's due to age (I'm in my 40s), maybe it's due to running my own business. But I am focused more on learning the new knowledge than on getting good results. So probably that's the reason.

I am looking forward to the rest of the course.

(I should be writing my dissertation now instead of this post.. Lol)

Parenting:

This is another area where I am constantly learning too.

Parenting is an anomaly. It is no easy task yet it is enjoyable at the same time.

I am learning everyday, just like my 2 yo and 4 yo.

Sometimes I flare up, especially when they do something that I have repeatedly said otherwise.

Back in my mind I knew they were just kids and we have to keep teaching like a broken record.

I also set in my handphone, reminders such as to be patient and no raising of voice. Yet from time to time I still find myself losing temper.

And I will always feel guilty thereafter.

There is much room for improvement in this area for me.

Most free time I have will be spent with these two cuties. I always look forward to these times and I try my best to keep other stuff such as work and school away during these times.

Investment:

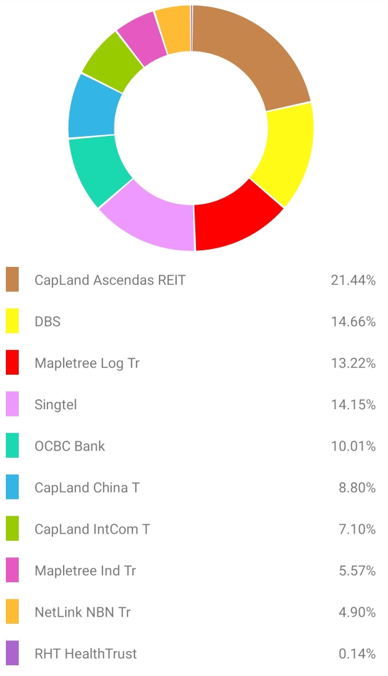

Have been adding Mapletree Industrial Trust in the last couple of months as share price fell to appealing levels.

Based on my purchased prices, dividend yield should sit nicely above 5.5% easily.

I will take a leaf from the recent PP price of $2.212 to determine my next level to add.

Despite their drop in latest dividend, I am of the opinion that the strength of their management team as well as geographical and asset class diversity amongst others, are good enough to avoid any drastic drop in financial performance in the long run.

One thing to note of course, is the impact of rate hikes on their borrowings and subsequent dividends.

If we are confident in the quality of the business, it is fine to add in tranches every month for long term investment which is what I'm doing now. Slowly and steadily building up the position. All the more better if it is in a short term down trend.

I have also increased my existing position in Ascendas Reit today.

Queued at last Friday but didn't get filled so tried again today.

Reasons for adding are largely the same as the above.

Others:

Finally bought a new phone recently after probably 6 years. Good bye Huawei Mate 10, hello Poco F5!

Have tried to postpone buying for as long as I can because it's such a hassle to transfer the stuff over. But alas my Mate 10's condition is getting from bad to worse. I have to take the plunge.

Just to complain abit here. The calender function in Poco F5 is really not to my liking.

It can't display the full entry if the description is too long. It also doesn't display our local holidays.

Anyone knows any calendar that can fulfil the above, kindly recommend it to me please.

Last but not least, I have also recently renewed my electricity plan with Senoko Energy.

Have to get the best plan for ourselves within the environment of rising costs of living.

I did a comparison and analysis earlier in this post.

Feel free to make use of the analysis.

If you use my referral code to sign up, a word of thanks to you.

Till the next post, good bye.