With the recent dip in share price of the various counters in my local watch list, I began to monitor more closely and started to plan my funds around in case the opportunity to add arises.

There are plenty of counters that I would love to add such as Mapletree Commercial Trust, Keppel DC Reit and ParkwayLife Reit. Unfortunately these are over valued at the moment.

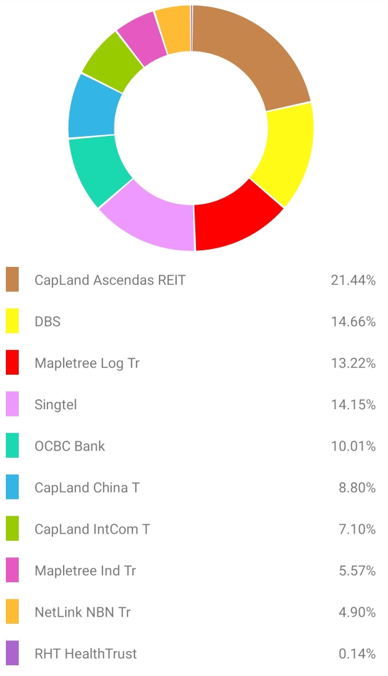

And there are plenty which I would love to accumulate more such as Mapletree Logistics Trust, CapitaLand Integrated Commercial Trust, DBS, OCBC, Mapletree NAC Trust, Netlink NBN Trust, Suntec Reit, Ascendas Reit and CapitaLand China Trust (CLCT).

All these are solid counters for a portfolio in an ideal world. Unfortunately in the real world, I am an ordinary person with limited funds so due diligence is extra important in my case.

Furthermore I have diverted a five figure sum to the US and HK markets recently so that left me with not much to take advantage of the dips in STI.

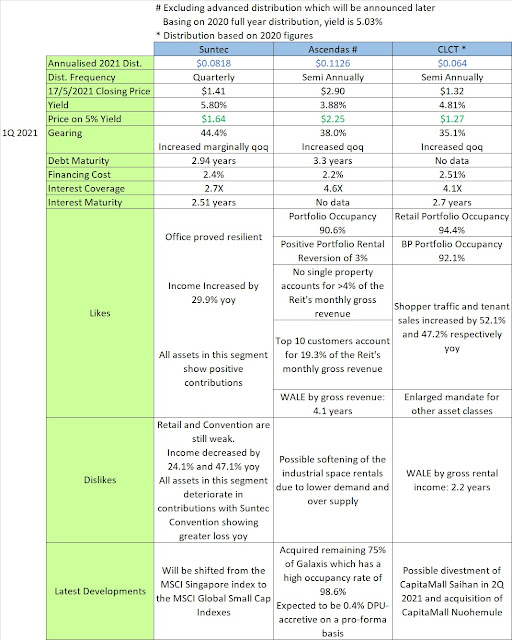

Of the above-mentioned counters, three of them have been inching towards my interested price points hence I decided to take a closer look and did some comparison as follows.

Note the data is garnered from the 1Q 2021 report of the respective counters and various sources found online.

Distribution Yield

Of the three, Suntec Reit appears to have the highest yield on paper. However notwithstanding last year's Covid-19, its distribution has been falling for the past three years and not without reason.

Ascendas Reit's dividend yield appears low at 3.9%. However that is excluded the advanced distribution which will be announced at a later date. Therefore the actual distribution should be higher or close to last year's figure.

If assessed purely based on distribution yield, I actually feel CLCT has the highest potential.

CLCT's distribution in this table is based on last year's figure since the distribution for this year has not been announced yet.

However during pre-Covid times, it has consistently hit 7% and above. Along with the new mandate, it has huge potential to go higher.

Gearing and Debt

Suntec Reit's gearing is the

highest and is at a level which I'm not really comfortable with. As such

it is also more likely to have rights issue in future.

Its financing cost is acceptable but its interest coverage is the lowest among the 3 counters.

Ascendas Reit performed the best in this area. Its gearing is only 38% with lowest financing cost and highest interest coverage.

CLCT has the lowest gearing among the three. Its financing cost is the highest but at an acceptable level. Furthermore its high interest coverage means no worries on the interests servicing.

Outlook

Suntec Reit's jewel in the crown has always been the office and mall segments where it achieved consecutive quarters of positive rental reversion.

For 1Q 2021, the office segment again proved its resilience.

Its venture into Australia seems to be an excellent move as well and has started to reap the rewards.

Unfortunately the good stuff ends here.

Contribution from the retail segment has fallen by 24.1%. The convention segment is worse at 47.1%.

For Suntec Reit, moving forward, a lot depends on how well and fast the retail and convention segments recover. Otherwise they will continue to be a drag on the overall performance with its effect cushioned by the Australian assets.

Recently it has been announced that Suntec Reit will be shifted from the MSCI Singapore Index to the MSCI Global Small Cap Indexes.

Frankly, I have no idea what the effect will be but I will continue to monitor this counter.

Ascendas Reit has always been a well-run business with high overall occupancy rate and well diversified tenant base.

With its recent addition of the European data centres and remaining 75% of Galaxis, it's exciting to see the future of this Reit especially these certainly won't be the last of their acquisitions.

Having said that, the diminishing demand for industrial space and overly supply might be a double whammy for all industrial Reits including Ascendas.

However the geographical and asset class diversification should soften any possible blow.

CLCT has a well balanced performance in terms of the various metrics.

On the macro front, its shopper traffic and tenant sales have improved tremendously YoY. Also, it has gotten rid of its most under-performing mall in its portfolio.

And all these are for the retail malls only which will eventually be reduced to 30% of CLCT overall asset mix in the future.

At the same time the most exciting development in my opinion is their new mandate of exploring other asset classes like business parks, logistics and data centres. The latter two are among my favourite asset classes by the way.

This is akin to unleash the rope that binds the feet of a fast runner. Suddenly he can run much faster and further.

Already, CLCT has taken a first step of adding business parks into its portfolio.

On the down side (and possibly up side), the portfolio WALE be it by NLA or GRI, is rather short ranging at 2 to 3.5 years.

If I remember correctly, this is by choice for flexibility in rental reversions.

Valuation and Growth

In terms of valuation, P/E ratio is not really relevant so I gave it a miss.

Based on P/B ratio, Suntec Reit and CLCT are both trading below their NAV.

Ascendas Reit is currently trading

at around 1.368 times P/NAV (NAV based on latest FY results) which is

slightly higher than its 5 year average of 1.284.

All three counters are currently trading below their 20- and 50 DMA with a death cross forming recently for Suntec Reit and CLCT.

For potential growth, I did not use the DYG calculation this time unlike before.

But judging purely from the macro factors, asset mix and results of the respective 1Q 2021 metrics, here is my verdict.

Suntec Reit: To add only when extra funds are available

Ascendas Reit: To add with slightly more safety factor

CLCT: To add with slightly more safety factor