Feb 2021

Portfolio Value after market close

S$130,363.45

None

Sold

ISOTeam @ 50,000 sharesCapitaLand @ 4,000 shares

Dividends

Suntec Reit @ $90.44

Short-Term Transactions

SPCE, NAKD, CHMA, SOS, SCKT, LODE

Summary

01 Feb 2021 STI Open: 2,896.32

26 Feb 2021 STI Close: 2,949.04

STI closed above its opening this month though we saw dips across the broad market for the last couple of days.

I sold ISOTeam and CapitaLand at net 67.5% loss and 19.3% profit respectively.

Reasons for selling will be explained below.

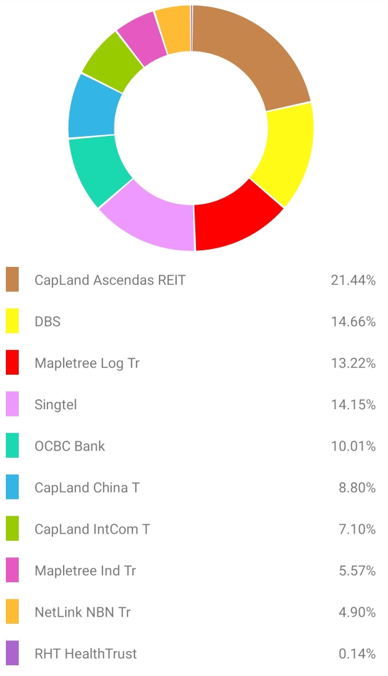

The funds will mostly likely be redeployed to either Ascendas Reit, CapitaLand China Trust or

Mapletree Industrial Trust.

I have made my pick if yesterday's closing price is anything to go by.

This is part of my portfolio rebalancing which I have wanted to adopt a more active approach this year.

I also intend to open a Syfe Equity100 portfolio with a small portion of the funds for managed investment in the overseas markets.

However I understand Syfe will be introducing a new product early next month so I'll wait for that to see how it compares to the existing offerings.

I continued to dabble with the US market this month with my initial small amount which is one that won't make me lose my sleep and which is something that I can afford to lose.

I consider this portion as my fun account / portfolio.

Little to no due diligence are done for this account. The trades are mostly based on momentum and price actions. The trades are also mainly intraday with tight stop losses.

ISOTeam

Sold it on 23rd Feb 2021 at $0.125 with a 67.5% net loss after dividends.

Surprisingly, I don't feel pain at all. It's like a mechanical, 'has to be done' move for me.

ISOTeam purchase was initiated about 4 years ago. The government was pumping billions into the construction industry which was already doing quite well.

My reasoning was that since I do not fancy investing into construction companies with their lumpy earnings (although I did contemplate about HLS for quite a long period due to its juicy dividends back then), I will invest into ISOTeam as a proxy to the industry.

ISOTeam is an established player in HDB and town council projects with constant project wins. As such I thought their recurring income would be more attractive to investors.

Unfortunately I was proven wrong.

This counter has became more illiquid over the years.

As a testament on how illiquid this counter is, I set sell order for nearly a week before my shares finally got sold.

There are several reasons that prompted me to sell.

Firstly, when the broader market is recovering from the March lows this year, ISOTeam's share price is still languishing near a 5 year low.

Even the slew of contract wins failed to catalyse the share price.

It just doesn't move in tandem with the market which likely points to company-specific reasons as per point 2 below.

Secondly, deteriorating fundamentals. The continual compressed gross profit margin (GPM) which hit below 5% in the latest concluded FY makes me wonder whether the business is sustainable.

A low margin might makes sense for commodities trading business which goes by higher volume. I.e. low margin high turnover.

But being in the engineering projects business myself, a 5% GPM is certainly a cause for alarm and I don't think it is sustainable for an engineering company.

One of the criteria I use for my stock screening is a net profit of minimum 10%. In this case ISOTeam is far off the mark (the GP is not even 10% let alone the net profit).

In fact they made a net loss in the FY ended June 2020.

And if I remember correctly, operating cash flow went in the red last year. The management explained that it is due to ageing of the accounts and upfront payment of project expenses.

Again, being in the engineering business myself, I don't find this normal at all.

Thirdly, opportunity costs are mounting. With the local market gradually recovering from the March lows and the US market hitting record highs recently, I felt the need to capture the upswing of the markets.

I'm pretty sure it is a good move to cut loss and move the funds to other growth stocks or dividend counters for my income portfolio.

The sale of this dead wood also fulfilled one of my investment aims set earlier this year.

Lastly, poor outlook. The company has guided that the near term is going to remain challenging for them and I am of the same view.

Although their order book has >$100 million worth of projects to be delivered over the next 2 - 3 years, I believed the margin is in single digit.

Cost of sales is also likely to increase as per my personal encounters in the industry. If ISOTeam didn't take steps to lock in vendor prices, margin might be further hit.

The integration of Pure Group into ISOTeam also didn't turned up as well as anticipated with the former likely to be loss-making in 1H FY21.

With no dividends declared for last year and I expect it to be the same for this year, there is no incentive to wait for the share price recovery which I feel can only happen in either of the following ways - 1) Acquisition by another company or 2) Drastically improve on its fundamentals.

But for now, I'm off this counter.

CapitaLand

Sold it on 24th Feb 2021 at $3.15 with a 19.3% net profit after dividends.

CapitaLand is another one of my long held counters.

Over the years it has been providing me decent dividend yield (4% against cost which is my minimum criteria) while I wait for the share price to hit my TP.

Couple of years back it nearly hit $4. I attribute that to the strong management team led by the capable Mr Lim Ming Yan.

I decided to sell it this time after it reported its first full year net loss in almost two decades, although that is partly contributed to revaluation losses.

Despite that, it upped its dividend payout ratio to pay a 9 cents dividend for 2020. This is lower than the 12 cents paid in previous years though.

As such my yield has fallen to 3% against cost. Sell, and transfer the funds for an easy 5% yield elsewhere is the logical move for now.

I have no qualms to buy the shares again if the price is right. Hint: Oct 2020.