Apr 2021

Portfolio Value after market close

S$147,010.00

S$147,010.00

Purchase

None

Sold

Dividends

Short-Term Transactions

GME PUT (closed), PLTR PUT (sold)

Summary

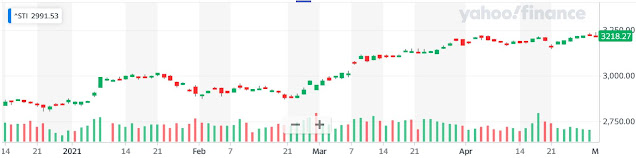

01 Apr 2021 STI Open: 3,181.68

30 Apr 2021 STI Close: 3,218.27

STI

continues to close above its monthly opening for the fourth consecutive month since the start of this year.

This month's is probably due to the good results from DBS which in turn lifted the share price of the other two local banks as well.

I would place closer attention to next month on the market's reaction to the rising cases of local Covid-19 infections.

For my SGD portfolio, value increased by 2.25% though I did nothing to it this month.

This is also largely driven by the rise in share price of the bank counters and partly offset by the fall in Reits.

Current spare cash level is about $10K, which I hope there are opportunities for me to plough into this SGD portfolio in the coming month.

For my Syfe Core Growth portfolio, I am seeing a small positive return so far though it would be more meaningful to see the returns in the long run.

Have DCAed into this portfolio yesterday and plans to continue this strategy every month end.

For

my USD portfolio, I have not done any intraday trading this month.

However I have closed the GME PUT that I wrote previously as an experimental first try.

It is a good experiment with a small gross profit of 5.6% for a holding of about one month. I think what's important is the knowledge gained in this practical trading.

Apart from this, I have sold another PUT this month for PLTR, expiring 21/5/2021 with a strike price of $21 and premium of $1.01.

I think at this price point there is a sweet balance between risk and reward.

I have touched abit on this previously.

Moving forward I will continue to use options as part of my investment / trading tools to augment my investable income.

And no, I have not touched cryptos yet though that was one of my investment aims set earlier this year.

It's tempting to read the enormous gains posted by others in online forums but I prefer to do more due diligence before going into that.

Will definitely update if I forayed into this area next time.